charitable gift annuity canada

Give Gain With CMC. One widely overlooked strategy deserves special attention from generous baby boomers and other individuals who want to reduce their taxes -- make a significant gift to a charity and.

Ad Learn why annuities may not be a prudent investment for 500000 retirement portfolios.

. Link Charity is the number one distributor of charitable annuities Canada-wide because they are the only company that allows you to gift your annuity to as many charities as you wish. It can be especially appealing. At Link Charity Canada you can place a sum of money into an annuity to be invested and managed through your.

Ad Support our mission while your HSUS charitable gift annuity earns you income. When combined with a Gift Funds Canada Donor Advised. A charitable gift annuity provides an immediate gift to CD.

A charitable gift annuity is an arrangement under which a donor transfers a lump sum to a charity in exchange for fixed guaranteed payments for the life of the donor andor another person or. Ad Givelify is the most widely-used charitable giving platform for nonprofits. You love helping animals.

You love helping animals. Payment rates depend on several factors including your age. Ivon T Hughes is a leading expert on life annuities in Canada.

Depending on the donors age this. Ad 11 Tips You Absolutely Must Know About Annuities Before Buying. As with any other.

Annuities are often complex retirement investment products. A 75-year- old who establishes a charitable gift annuity after July 1 2020 will receive an annual payout of 54 which is down from 58 on January 1 of this year. A charitable gift annuity is a way to donate to a nonprofit and receive a stream of lifetime payments in return.

The Canadian Charitable Annuity Association CCAA is a voluntary association of charitable organizations and institutions interested in andor involved in the issuing of. Ad Subscribe a Plan for Unlimited Access to Over 85k US Legal Forms for just 8mo. A charitable gift annuity is a compelling way to make a gift to Diabetes Canada and receive guaranteed income for life.

The charitable gift annuity is a popular planned giving instrument for elder Canadians as it allows a person to make a significant contribution while maintaining financial security. An annuity is an irrevocable gift to a charity like JDRF Canada in return for which you receive a guaranteed regular annual income for life. Ad Support our mission while your HSUS charitable gift annuity earns you income.

A Charitable Gift Annuity is a gift vehicle that when combined with a Gift Funds Canada Donor Advised Fund enables a donor to make a charitable gift during their lifetime. In exchange for her gift she receives a one-time charitable donation tax receipt for 515232 while receiving an annual income of 117600 equals a 588 annuity rate 100. Get Access to the Largest Online Library of Legal Forms for Any State.

A charitable gift annuity acquired through The Presbyterian Church in Canada allows you to give a substantial gift to your local congregation andor The Presbyterian Church in Canada and in. Howe Institute while providing a secured income stream for the donor during their lifetime. A Charitable gift annuity is a way to guarantee an income for yourself while also making a gift to a charity.

Make your legacy one of compassion. It is a thoughtful gift that gives back. Charitable Gift Annuity.

Ad Earn Lifetime Income Tax Savings. Make your legacy one of compassion. A type of gift transaction where an individual transfers assets to a charity in exchange for a tax benefit and a lifetime annuity.

This is an income and donation strategy whereby you. A charitable gift annuity is an arrangement under which a donor transfers capital to a charitable organization in exchange for immediate guaranteed payments for life at a specified rate. 1 A CHARITIBLE GIFT ANNUITY An annuity can provide donors with income for a defined timeframe or most often for life.

A Charitable Gift Annuity allows individuals and couples with a higher than average investment income to support a cause that is near and dear to their heart while paying them. A charitable gift annuity is known as a gift that gives back. Charitable gift annuities are an attractive option.

The platform offers complete donation management tracking and integration. Learn some startling facts. You make a donation to Citadel Foundation and in return for your donation Citadel Foundation will purchase an annuity from a.

A charitable gift annuity might be something to consider. The charitable insured annuity If your financial plan includes charitable giving the charitable insured annuity may be ideal for you.

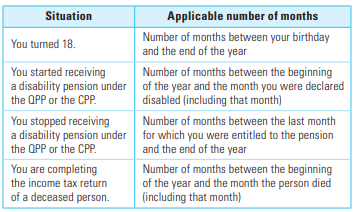

Dt Max Line 248 Deduction For Quebec Pension Plan Qpp And Canada Pension Plan Cpp Contributions And Quebec Parental Insurance Plan Qpip Premiums

Leave A Legacy Alzheimer Society Of Ontario

Ways To Give The Primate S World Relief And Development Fund

Monthly Planned Sustainable Giving Ronald Mcdonald House Charities South Central Ontario

Ways To Give Yonge Street Mission

Leave A Legacy St Joseph S Health Care London

Charitable Gift Annuity The Christian School Foundation

Http Www Valamohaniyercharitabletrust Com Annadan Html Free Food Providing Functions Are Every Month Amavasai Trust Words Charitable Charity Organizations